As a administration advisor, whether or not you’re advising on monetary points, staffing, or firm hierarchy, your shoppers worth your recent perspective and problem-solving expertise.

That’s, until a time comes after they don’t.

Although you’re an skilled in your area, your well-intended and considerate options will not be executed as deliberate, which might find yourself with unhealthy outcomes, missed timelines, or any variety of not-so-great outcomes. This will additionally result in a number of accusing fingers pointed in your route.

That is the place our Administration Consultants Insurance coverage Information is available in.

Advisor Insurance coverage, Made Straightforward

A number of insurance policies, one quote. Your recommendation shouldn’t price you.

We’ll assist you to perceive how insurance coverage may also help you in your administration consulting enterprise, which insurance policies to prioritize, the potential prices, and tips on how to discover the correct supplier for you.

In your line of labor, you want correct insurance coverage so you may take the massive dangers you want to win — with out the entire worries.

The Dangers Administration Consultants Face

Not surprisingly, many of the risks and liabilities faced by management consultants revolve round coping with shoppers.

Claims of malpractice or negligence might result in a lawsuit just because a consumer alleges that your steerage is unhealthy recommendation.

In at the moment’s digital-first world, a slew of cyber threats additionally goal unbiased consultants such as you who, as a result of restricted monetary assets, may not have one of the best safety measures in place. These threats to your online business can embody knowledge breaches, ransomware, malware, phishing makes an attempt, and extra.

Fortunately, insurance coverage can cowl prices related to authorized charges to defend your self towards many widespread liabilities. For instance, a consumer might disagree that you just delivered in your scope of labor, however you imagine you’ve fulfilled the promise. In that situation, which is likely one of the commonest that you just’ll face, administration consultants insurance coverage may also help all through a authorized dispute.

Relying on the protection you select for your online business, administration consultants insurance coverage can present monetary safety towards claims related to:

- Lawsuits alleging errors or omissions

- Cyberattacks

- Office accidents

- Property injury

Administration Consultants Insurance coverage: The Insurance policies

Elements corresponding to the scale of your online business, the character of your work, your location, variety of workers (in case you have them), and the kind of property you’ve can have an effect on how insurers consider your dangers. To assist cowl the everyday dangers related together with your line of labor, you’ll need to contemplate the next.

- Professional Liability: Skilled legal responsibility insurance coverage is often often called errors and omissions (E&O), skilled indemnity, or malpractice insurance coverage. This sort of protection will preserve your online business protected against civil lawsuits ensuing from alleged negligence, widespread errors, omissions and misrepresentation claims. Simply understand that if you’re in reality responsible, you’ll should show that your actions and outcomes weren’t achieved deliberately or with malice.

- Cyber Insurance: Additionally known as cyber threat insurance coverage or cyber legal responsibility insurance coverage protection, cyber insurance coverage will allow you to switch the prices concerned with restoration from a cyber-related safety breach or related occasions. Once more, understand that having correct threat administration plans in place may also help with the price of this insurance coverage, to not point out make the claims course of a bit simpler too.

- General Liability: A business normal legal responsibility insurance coverage coverage gives safety towards the dangers that just about all enterprise house owners face, together with any claims of damage associated to your online business; it additionally responds to claims of negligence made by a 3rd occasion.

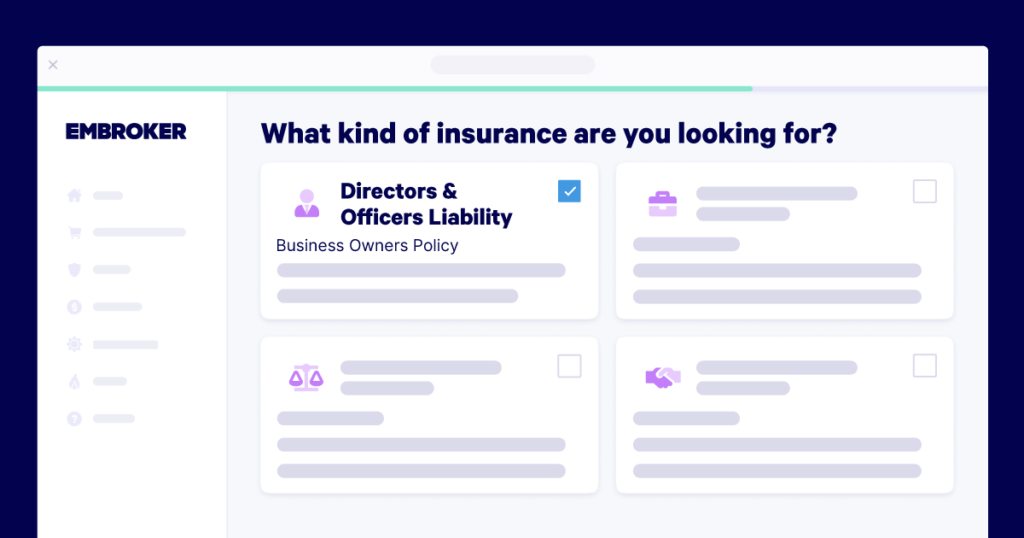

- Business Owners Policy: A Enterprise House owners Coverage (BOP) is a package deal of a number of insurance coverage insurance policies in a single designed to deal with your particular enterprise wants. For instance, in case you work out of an workplace or have designated part of your own home as your official workspace, your agent might advocate commercial property insurance. They could additionally recommend commercial auto insurance in case you journey by automotive for work.

Insurance coverage protection prices will differ relying on a number of elements. For starters, the sorts of providers you present can impression worth, as can your location, any enterprise property you could have, the varieties of kit you might use, your income, and in case you have workers.

Tips on how to Get the Most Out of Your Administration Consultants Insurance coverage

As a administration advisor you might need to maximize the impression of your insurance coverage by integrating it into contracts and consumer agreements — some insurance coverage necessities can be utilized to switch contractual threat to different events, thereby lowering your threat.

It’s really not unusual for business contracts to incorporate insurance coverage necessities. To include it into your personal agreements, you’ll need to begin by making a kind for shoppers that may collect data like: who’s concerned; the scope of labor; potential threat of loss exposures; challenge phrases and site; the estimated worth of the challenge; and the consumer’s most well-liked size of insurance coverage necessities. This fundamental details about the challenge will assist set expectations and set up threat transparency.

What to Search for in Administration Consultants Insurance coverage and Insurers

When working as a advisor, you’re answerable for the success of others earlier than you may actually get pleasure from your personal success. Understandably, there might be ups and downs alongside the best way.

That’s why discovering a supplier who can match into your routine and work with you all through these hectic instances is vital.

A method to make sure a supplier is up for the duty is to see if they provide digital options for submitting claims and for the general administration of your insurance policies. In spite of everything, who has time to attend on maintain to talk with a dealer?

It’s additionally essential to discover a supplier who can customise your protection so that you just solely pay for what you want — and don’t find yourself carrying plans you’ll by no means use.

Embroker is right here for you at each step of your insurance coverage journey. Whether or not you’re fact-finding, seeking to get a quote or need to replace your present coverage, you are able to do all of it on-line in minutes. And in case you want help, we’re only a chat, name, or electronic mail away.

Advisor Insurance coverage, Made Straightforward

A number of insurance policies, one quote. Your recommendation shouldn’t price you.