An insurance declare comes at a anxious time in a buyer’s life, typically making it a damaging expertise. Not less than, that’s what you may assume. That’s why I used to be shocked when our newest analysis report, Why AI in Insurance Claims and Underwriting,

Pace of settlement drives claims satisfaction in insurance coverage

General, our survey discovered that 70% of insurance coverage policyholders mentioned they have been both glad or very glad with how their insurance coverage firm or agent dealt with their declare.

For claims, that is fairly excessive. And our survey is just not the one knowledge level to point out this. A 2021 J.D. Power survey focused on auto insurance confirmed record-high buyer satisfaction on claims, hitting 880 on a 1,000-point scale. An identical 2021 J.D. Power survey on property claims confirmed a slight dip in satisfaction charges (from 883 to 871), however this broke a 5-year streak of steadily growing satisfaction scores and is probably going as a result of circumstances indirectly associated to insurers (like provide chain disruptions and materials shortages associated to the pandemic). So, what’s inflicting these rising satisfaction charges?

Omnichannel communication and transparency are two causes. Most insurers enable clients to open a declare on a web site or app. Know-how affords comfort by way of utilizing images for an inspection as an alternative of scheduling an individual to return on-site. And a few insurance coverage corporations provide a dashboard to trace a declare all through its lifecycle.

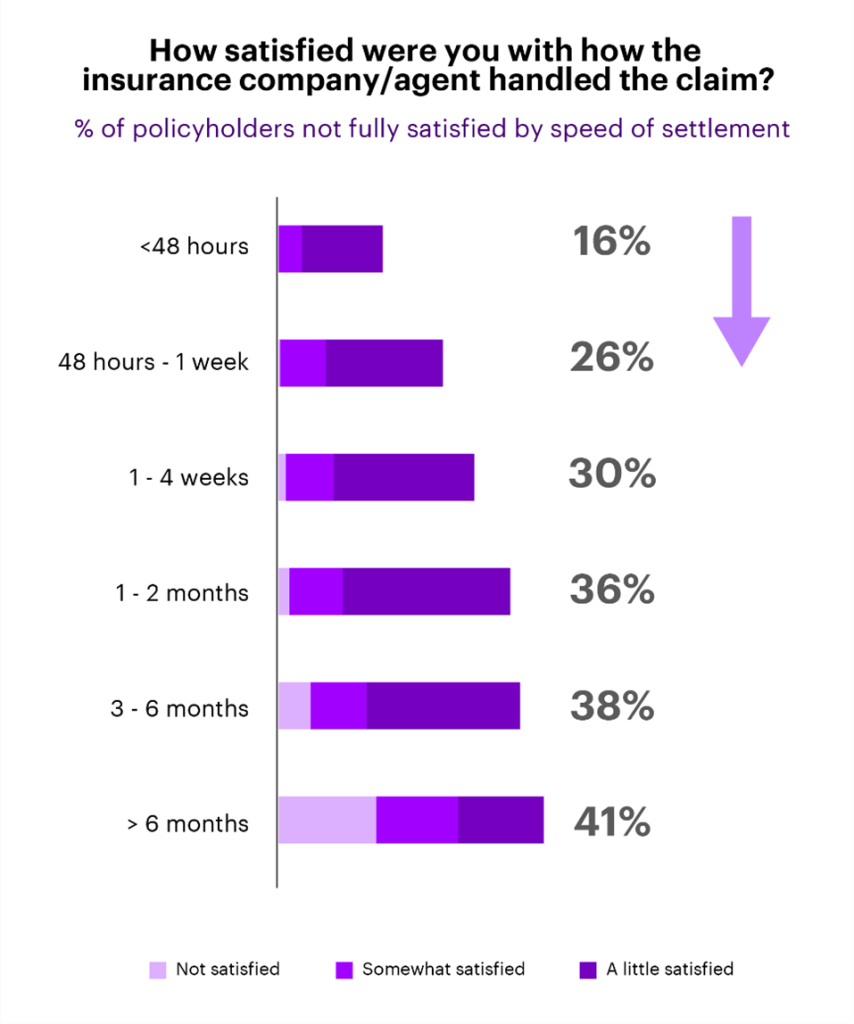

These are all necessary modernizations which have helped the claims expertise be extra seamless. Nonetheless, there’s one piece that, in keeping with our survey, drives satisfaction charges greater than the rest: pace of settlement. The longer it takes to settle a declare, the much less glad that policyholder can be.

This perception is especially necessary for insurers, since claims dissatisfaction is a significant factor in driving policyholders to modify to a different firm, with 74% of dissatisfied clients both saying they did change suppliers (26%) or are contemplating it (48%).

Insurers ought to give attention to AI to construct on excessive claims satisfaction charges

Understanding that pace of settlement is a core driver, how do insurers proceed to get excessive ranges of satisfaction and, extra importantly, construct on that?

For a few years, insurers have been targeted on the omnichannel. We’re at a degree now the place continued funding in omnichannel is giving diminishing returns. After all, this isn’t to say omnichannel needs to be ignored. New routes that focus on youthful generations, like chat apps (WhatsApp, and so forth.), will nonetheless be an necessary technique for insurers to increase their buyer base. And perfecting or modernizing no matter omnichannel providing insurers at present have can be essential to remain related. What I’m saying is that omnichannel is low-hanging fruit—most of which we’ve picked already.

As a substitute, insurers ought to give attention to AI to automate the settlement course of to be quick, simple and correct. After all, that is simpler mentioned than performed. Automating the settlement course of requires sturdy knowledge and analytics capabilities all related in a single ecosystem.

Disconnect between intention and motion

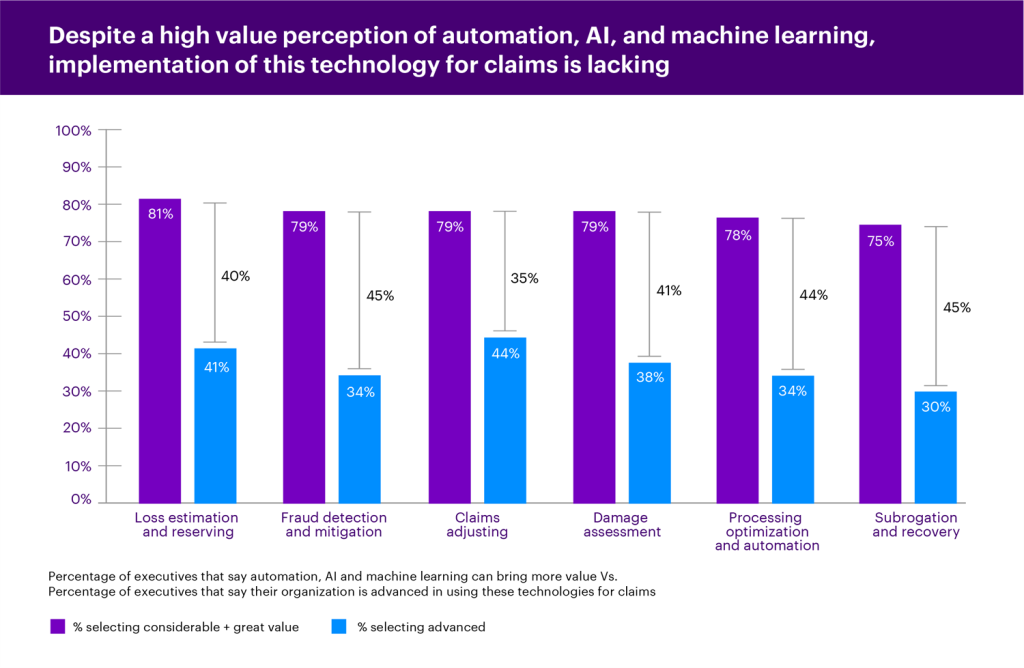

Executives already know the significance of utilizing AI in claims. The graph beneath reveals that, for every space of the claims worth chain, at the very least 75% of executives mentioned AI and machine studying can convey “appreciable” or “nice” worth.

But, there’s a disconnect between this intention and taking motion. The identical graph reveals this hole, the place even probably the most superior space (claims adjusting) nonetheless has solely 44% of executives saying they’re superior of their use of AI, automation and machine studying. On this situation, our definition of “superior” is after the extent “utilizing in preliminary levels.”

Insurance coverage executives ought to take a look at priorities holistically

So, about 80% of executives understand the worth of AI in claims, and about 40% think about themselves superior in numerous areas. Not surprisingly, investments in claims will speed up over the subsequent three years, with 65% of these we surveyed planning to speculate greater than $10 million.

Insurers shouldn’t be discouraged, nonetheless, as a result of pace of settlement priorities align to different government priorities, similar to lowering admin prices and plugging claims leakage—and the options are the identical. That’s why executives ought to keep away from making an attempt to unravel every downside individually and as an alternative ask how AI, machine studying and different automation can rework the enterprise in a approach that can concurrently hit a number of priorities. For instance, growing pace of settlement by way of automation will naturally scale back admin prices and keep away from claims leakage, whereas growing buyer satisfaction and retention.

Insurance coverage leaders additionally have to be brave to sort out these bigger challenges and keep away from placing an excessive amount of time and power in less complicated priorities (like omnichannel).

Insurers know the sort of worth AI can provide, however they’re falling behind in implementation. Fortunately, the latest surge in direction of the cloud will assist. Cloud is an important basis to leverage real-time knowledge and modeling that can gasoline such a automation.

General, there’s nonetheless a variety of work to do to get expertise platforms to the purpose the place they’ll automate pace of settlement and higher leverage AI throughout the enterprise. Nevertheless it’s clear that AI and automation is the place the funding needs to be going for insurers to reap probably the most advantages: glad clients, empowered staff and a extra resilience enterprise. Learn our full report on AI-led Transformation in Insurance to study extra.

Get the newest insurance coverage business insights, information, and analysis delivered straight to your inbox.

STANDARD DISCLAIMER: