Kirk Vartan pays greater than $2,000 a month for a high-deductible medical health insurance plan from Blue Protect on Coated California, the state’s Reasonably priced Care Act market. He might have chosen a less expensive plan from a special supplier, however he needed one that features his spouse’s physician.

“It’s for the 2 of us, and we’re not sick,” stated Vartan, normal supervisor at A Slice of New York pizza retailers within the Bay Space cities of San Jose and Sunnyvale. “It’s ridiculous.”

Vartan, who’s in his late 50s, is certainly one of thousands and thousands of Californians struggling to maintain up with medical health insurance premiums ballooning quicker than inflation.

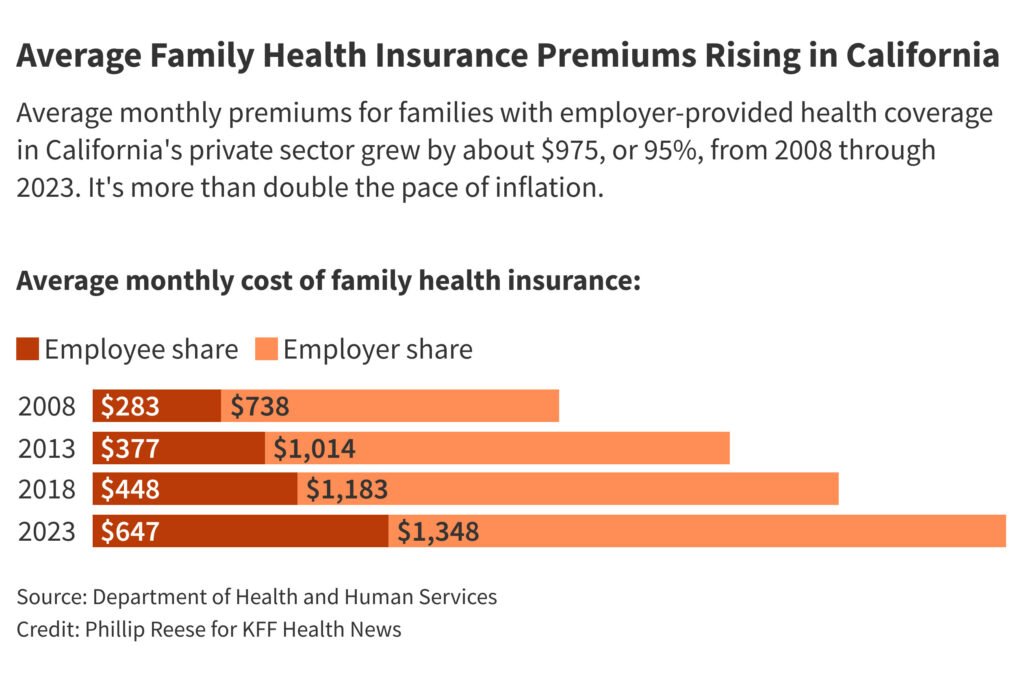

Common month-to-month premiums for households with employer-provided well being protection in California’s personal sector almost doubled during the last 15 years, from simply over $1,000 in 2008 to virtually $2,000 in 2023, a KFF Well being Information evaluation of federal data shows. That’s greater than twice the speed of inflation. Additionally, staff have needed to soak up a rising share of the fee.

The spike will not be confined to California. Common premiums for households with employer-provided well being protection grew as quick nationwide as they did in California from 2008 by means of 2023, federal data shows. Premiums continued to grow rapidly in 2024, in accordance with KFF.

Small-business teams warn that, for employees whose employers don’t present protection, the issue might worsen if Congress doesn’t lengthen enhanced federal subsidies that make medical health insurance extra inexpensive on particular person markets akin to Coated California, the general public market that insures greater than 1.9 million Californians.

Premiums on Coated California have grown about 25% since 2022, roughly double the tempo of inflation. However the change helps almost 90% of enrollees mitigate excessive prices by providing state and federal subsidies based on income, with many households paying little or nothing.

Rising premiums even have hit authorities employees — and taxpayers. Premiums at CalPERS, which offers insurance coverage to greater than 1.5 million of California’s energetic and retired public staff and relations, have risen about 31% since 2022. Public employers pay a part of the price of premiums as negotiated with labor unions; employees pay the remaining.

“Insurance coverage premiums have been going up quicker than wages during the last 20 years,” stated Miranda Dietz, a researcher on the University of California-Berkeley Labor Center who focuses on medical health insurance. “Particularly within the final couple of years, these premium will increase have been fairly dramatic.”

Dietz stated rising hospital costs are largely in charge. Shopper prices for hospitals and nursing properties rose about 88% from 2009 by means of 2024, roughly double the general inflation fee, in accordance with information from the Department of Labor. The rising price of administering America’s huge well being care system has additionally pushed premiums greater, she stated.

Insurance coverage corporations stay extremely worthwhile, however their gross margins — the quantity by which premium revenue exceeds claims prices — had been pretty regular throughout the previous couple of years, KFF research shows. Below federal guidelines, insurers must spend a minimum proportion of premiums on medical care.

Rising insurance coverage prices are chopping deeper into household incomes and squeezing small companies.

The common annual price of household medical health insurance provided by personal sector corporations was about $24,000, or roughly $2,000 a month, in California throughout 2023, in accordance with the U.S. Department of Health and Human Services. Employers paid, on common, about two-thirds of the invoice, with employees paying the remaining third, about $650 a month. Employees’ share of premiums has grown quicker in California than in the remainder of the nation.

Many small-business employees whose employers don’t provide well being care flip to Coated California. Over the last three many years, the share of companies nationwide with 10 to 24 employees providing medical health insurance fell from 65% to 52%, in accordance with the Employee Benefit Research Institute. Protection fell from 34% to 23% amongst companies with fewer than 10 staff.

“When an worker of a small enterprise is not capable of entry medical health insurance with their employer, they’re extra prone to depart that employer,” stated Bianca Blomquist, California director for Small Business Majority, an advocacy group representing greater than 85,000 small companies throughout America.

Kirk Vartan stated his pizza store employs about 25 individuals and operates as a employee cooperative — a enterprise owned by its employees. The small enterprise lacks negotiating energy to demand reductions from insurance coverage corporations to cowl its employees. The most effective the store might do, he stated, had been costly plans that will make it exhausting for the cooperative to function. And people plans wouldn’t provide as a lot protection as employees might discover for themselves by means of Coated California.

“It was a lose-lose all the best way round,” he stated.

Mark Seelig, a spokesperson for Blue Protect of California, stated rising prices for hospital stays, physician visits, and pharmaceuticals put upward stress on premiums. Blue Protect has created a new initiative that he stated is designed to decrease drug costs and go on financial savings to customers.

Even at California corporations providing insurance coverage, the share of staff enrolled in plans with a deductible has roughly doubled in 20 years, rising to 77%, federal information reveals. Deductibles are the quantity a employee should pay for many forms of care earlier than their insurance coverage firm begins paying a part of the invoice. The common annual deductible for an employer-provided household medical health insurance plan was about $3,200 in 2023.

Over the last 20 years, the price of medical health insurance premiums and deductibles in California rose from about 4% of median family revenue to about 12%, in accordance with the UC Berkeley Labor Middle, which conducts analysis on labor and employment points.

In consequence, the middle discovered, many Californians are selecting to delay or forgo well being care, together with some preventive care.

California is making an attempt to decrease well being care prices by setting statewide spending growth caps, which state officers hope will curb premium will increase. The state just lately established the Office of Health Care Affordability, which set a five-year goal for annual spending development at 3.5%, dropping to three% by 2029. Failure to hit targets might lead to hefty fines for well being care organizations, although that probably wouldn’t occur till 2030 or later.

Different states that imposed related caps noticed well being care prices rise extra slowly than states that didn’t, Dietz stated.

“Does that imply that well being care turns into inexpensive for individuals?” she requested. “No. It means it doesn’t worsen as shortly.”

This text was produced by KFF Health News, which publishes California Healthline, an editorially impartial service of the California Health Care Foundation.